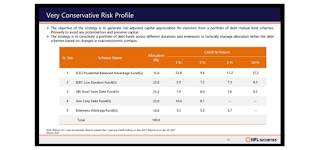

Chapter 6: Matching the Risk Profile and Asset Allocation

Dear Reader, *DISCLAIMER* Every example, text in this blog does not constitute any investment advice in any product or does not directly or indirectly promote any company / mutual fund/securities companies. Please read all the five chapters of this blog at: PPF (Practical Personal Finance) Series (ppfbypathikvariya.blogspot.com) if you are new to this blog Frankly, this is going to be a very small post! This post just tries to give you an example, as to, what kind of asset allocation you should have, based on your risk tolerance profile. Please note that the text below does not constitute any investment advice. Neither I am qualified to offer any investment advice. The below text, primarily taken from Best mutual funds SIP: Best mutual fund SIP portfolios to invest in 2020 (indiatimes.com) has been used to demonstrate (as an example) as to how you should go about planning your asset allocation. If you visit this website, it clearly shows you how different portfolios of mutual fund