Chapter 6: Matching the Risk Profile and Asset Allocation

Dear Reader,

*DISCLAIMER* Every

example, text in this blog does not constitute any investment advice in any

product or does not directly or indirectly promote any company / mutual

fund/securities companies.

Please read all

the five chapters of this blog at: PPF

(Practical Personal Finance) Series (ppfbypathikvariya.blogspot.com) if

you are new to this blog

Frankly, this is

going to be a very small post! This post just tries to give you an example, as

to, what kind of asset allocation you should have, based on your risk tolerance

profile.

Please note that

the text below does not constitute any investment advice. Neither I am

qualified to offer any investment advice. The below text, primarily taken from Best

mutual funds SIP: Best mutual fund SIP portfolios to invest in 2020

(indiatimes.com) has been used to demonstrate (as an example) as to

how you should go about planning your asset allocation.

If you visit this

website, it clearly shows you how different portfolios of mutual funds are

designed for the people with different risk tolerance.

Some thumb rules

are:

1. 100

Minus Rule: This

(thumb rule) argues that one should invest total percentage of investible

amount in equity based on 100-current age formulae. For example, if your

current age is 20, then you should invest 80% in equity and should reduce this

portion as you age. So, at the age of 40, the equity portion in your investment

should be 60%.

2. Gold: The investment in gold should be

around 10 to 15% so that it can act as a hedge against the risk of equity portion

of your investment.

3.

Investment beyond Indian borders: Investing in American or other world companies will

allow you to diversity your investment beyond India. The American or other

countries' economies have different economic cycle. And hence, in case, Indian

economy goes through a rough patch, investment in such economies will give some

diversification to your portfolio. But beware, such investments are extremely

risky and should be done only if you understand the risks associated with such

investments or if you have a capable advisor.

4.

Ability to take risk: If you have a stable job with good salary, a big inheritance, you

can take big risks. But if you have limited income, with a lot of

responsibilities, it may not allow you to take too much risk.

So, based on this,

you should carefully plan and manage your portfolio. As every individual's

condition is unique, no standardized solutions can be offered. You must meet an

expert and plan your asset allocation, based on your needs and capacities (to

take risk etc.)

5.

Goals: One

thing that should decide your investment is also goal based investing. Every RD

installment or SIP installment you have per month, must be leading to some

goals (financial goals). The financial goals can be divided into three categories:

short, medium and long term. Though, there is no strict definition of

short-term, medium-term and long-term goals, the goals that fall within (up to)

one year's horizon may be considered as short-term goals. Medium term goals may

be having a time line upto five years. Other long term goals may have a time

horizon up to 10 to eve 20+ years.

- Short term

goals' examples: Create an emergency fund, Pay the down payment of the car (to

be bought next year) etc.

- Medium term

goals' examples: Want to buy a house after three to five years, Want to plan a

foreign trip in 2025 (considering that the current year is 2021)

- Long term goals'

examples: Want to plan for retirement, child's marriage, child's future

education.

Examples may be:

Short Term Goal:

Create an Emergency Fund of Rs. 0.1 million in one year. Start an RD of Rs.

8,500 approx for one year or start an SIp of Rs. 8,500 in a liquid fund for one

year.

Medium Term Goal:

Want to plan a foreign trip after 5 to 7 years. Start an SIP of appropriate amount

in a conservative product with some equity exposure, like any balanced

advantage fund.

Long Term Goal:

Plan for retirement. The retirement is due in 2040 (considering the current

year is 2021): Invest in flexicap funds, shares, gold etc.

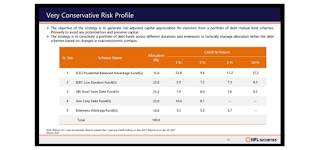

Some model portfolios

from IIFL (Marketing

Update Apr 2019 (indiainfoline.com)) - copyright - India Infoline

Securities Ltd. (IIFL Securities Ltd. )

i like this article, i want to more article in this topic

ReplyDeleteby : FinanceTube

Thanks for writing this great article! It’s very informative, and you included some great points to the equally great article regarding

ReplyDeleteSBI share price