PPF (Practical Personal Finance) Series Diaries: Chapter 2: A Defensive Beginning To The Investment Journey (Importance and Role of Insurance)

If you are here, it means, you are interested in practical personal finance. No unnecessary theories or jargon, but only, basic practical explanation of basic personal finance principles is what you will find in this series. I request you to read chapter 1 of this series, if you have not already read it. You can read it here: https://ppfbypathikvariya.blogspot.com/2020/05/ppf-practical-personal-finance-series.html

I have always cherished one interview of Wasim Akram (https://www.indiatoday.in/magazine/interview/story/19990215-sachin-tendulkar-has-a-very-solid-defence-in-test-cricket-wasim-akram-780180-1999-02-15). The title talks about why Sachin is a great batsman, it is because, he has a solid defense. One cannot be a great attacking batsman without solid defense (Shahid Afridi). The same is applicable to a military. A strong military is not the only one with strong attacking abilities, it must have equally good defense. Without it, it will become vulnerable to first round of aggressive attacks from the enemies.

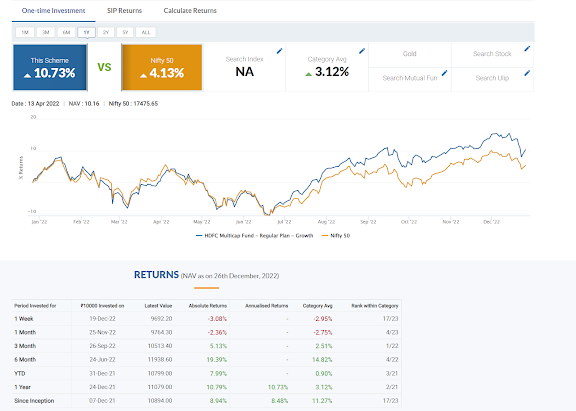

The same principle is somewhat applicable to the personal finance. Many people want to start an SIP, a PPF account, an emergency fund etc. Many boast about achieving early retirement by investing in share market etc. But the truth is, investing in share or any securities, comes with its own set of risks. We have seen this in 2008 and 2020. Minimum five years' returns were washed away in March 2020 in stock markets. So, if one is investing aggressively, one needs a strong defense to deal with such shocks. While diversification is one way, there are a few steps one needs to take prior to diversification - and that is, actually creating a strong defense for your portfolio and investments.

The first two products that one must buy are: A vanilla term insurance plan and a health insurance plan. One should not depend on the term or health insurance provided by the employer as they will go away with the change in job (or if you lose the job). How much cover or what products should you buy will required a dedicated series of blogs. Here, our discussion focuses primarily on why these two types of insurance are a must.

First the term insurance. It is said that you should have a vanilla term insurance (life) which covers risk equal to (upto) 20 times of your annual salary. There are no scientific rules on how much risk cover you should have. But minimum 10 times of your annual salary may be a good idea. I view this differently. According to me, you should have a cover, which covers following: all outstanding loans like home, car etc, an amount which can fetch monthly interest income equivalent to your current salary, any other big and unavoidable expenditure that is foreseeable in next three to five years (like higher education of a child). So, let us take a basic example on how much you should have. Say your salary is 50,000. So that means your yearly salary * 10 comes to 6 million. Then, let us say you are serving two loans with principal amount of 2.5 million. So, now the figure is 6 million + 2.5 million = .8.5million. Plus, you will need 1.5 million for your young girl's education after 5 years. Then the total comes to 10 million. Plus, you also want that some money should be left to generate interest income. Assuming the interest of 5% PA (post tax), 5 million more cover is added. So, in short, you must have minimum 15 million (1.5 crore)'s insurance. This is a very basic calculation. For actual calculation, I would urge you to seek services of a SEBI certified financial planner.

Now, when it comes to health insurance, there are too many varieties to cover. But the simple fact is that health costs are rising faster than our typical inflation. You can google it. So a cover of Rs 1 million that covers hospitalization expenses would be a bare minimum requirement. Plus, you can buy family floater that covers all family members in one policy. Such plans are cheap. Though some experts believe one should have individual health cover. That advice should be left to an expert only. Why you need a health cover is not difficult to understand now. COVID19 treatment costs 5 to 10 million rupees in good hospital.

Now let us think, that you start investing in mutual fund (equity) SIPs, without the above two insurances. And you do not have any emergency fund (or it is limited). What happens if one of the family members has to be hospitalized? Or what if the breadwinner dies? In such scenarios, the above two products will stand by like a strong defense. They will make sure that your financial planning is not compromised. They will help you absorb the shocks of financial emergencies. Especially health insurance becomes too critical now. You are too vulnerable without it.

Last thing is, you should not mix life insurance + investment. Most of the old time products like typical money saver plan, retirement plan, or endowment plans should be avoided. Rather, you should stick to a vanilla (pure) term insurance plan only. Though ULIPS (Unit Linked Insurance Scheme) were villains in the past, such plans are now better and can be a good choice if their expense ration is less and if the investor feels that he lacks to stay invested in Mutual Funds during the testing times. The ULIPS, because they come with a mandatory lock in period, are not easily stoppable. But still, a term insurance + Mutual Fund SIPs are better. In short, you should not buy an insurance product, whatever may the sales pitch of the agent. If you look at the returns in such policies, it would hardly 4 to 6%. So, one thing is, you must make up your mind to not buy insurance for investment. Tell you insurance agent: that you only want a term insurance in which there is no money back, no one time payment or no other facility. You pay your premium and the term insurance continues. You stop paying it, and it discontinues - something that happens with health and car and two wheeler insurance.

So, in short, based on our discussion in my previous PPF blog and this one, the conclusion is very clear. Before you start investing, you must have three things: An emergency fund, a term insurance and a health insurance. Staring to invest without these three is akin to attack an enemy with missiles without having a radar!

Comments

Post a Comment