Senior Citizens' Financial Investment - Problems and Solutions

SENIOR CITIZENS' FINANCIAL INVESTMENT - PROBLEMS AND SOLUTIONS

[A] Introduction:

I have been approached by many senior citizens or retirees, who want advice on their retirement investment. While I am not qualified (nor do I want to be one in future) to offer exact solutions to their financial planning related issues, as each one must be having a unique level risk tolerance and reward expectation. But still, here is a compilation of the schemes, that are generally preferred by the senior citizens in India. Please keep in mind that the article avoids using technical jargons and has been written using the lucid language, that a common man (CM) or aam aadmi or person (AAP) can understand!!!

[B] Discussion: Let us discuss each scheme in detail, with pros and cons:

1. Senior Citizen Savings Scheme (SCSS):

Salient Features:

- Very safe. Backed up by the Central Government.

- Age to Enter: 60 Years or Above

- Hindu Undivided Family (HUFs) and Non-Resident Indians (NRIs) are not allowed to avail this scheme. The exception is those, who opted for Voluntary Retirement Scheme (VRS) or Superannuation during the age group of 55-60 or retired defense personnel aged between 50 to 60.

- Rate of Interest is 7.4%. These rates are reviewed every quarter. The new rates apply to the deposits, booked on the day of change of interest, or after that. Already booked deposits get the rate of interest, which was prevailing, at the time of which, the deposit was booked. Already invested investors will not be affected by the change of interest. That way, this product offers fixed interest rate.

- Maximum limit to invest is Rs. 30 Lakh as per announcement in the budget of February 2023. Minimum is Rs. 1000. Individual or join accounts are allowed. But only Rs. 15 lakh of investment is allowed per account.

- Interest payout is on quarterly basis, on the first day of April, July, October and January. Growth option (reinvestment of interest) is not allowed.

- Maximum Tenure is 5 years. One time extension of 3 years is allowed. Extension is treated as reinvestment and the prevailing rate of interest will apply at that time.

- Minimum lock in is one year. Penalty, if account is closed after one year is, 1.5% of the deposit amount. If closed after 2 years, 1% of the deposit amount. For the account, that has been extended after 5 years, one can close it for no penalty, after one year of extension is over.

- The tax treatment is ETT. That means Exempt at the time of investment. Taxed on interest earned and Taxed when money is given back to you. If the interest you earn in a financial year is more than Rs. 50,000, Tax Deduction at Source (TDS) will be applied.

Here is the calculator of SSCS: SCSS Calculator : Senior Citizen Saving Scheme Calculator Online (scripbox.com)

Senior citizens can claim a tax deduction of up to Rs 1.5 lakh for investments in SCSS under Section 80 C of the Income Tax Act, 1961.

2. Pradhan Mantri Vaya Vandana Yojana: (PMVVY):

- Scheme introduced in 2017.

- Operated by LIC. A Retirement-Cum-Pension Plan

- You get an annual fixed amount (called annuity), right after you invest a fixed amount

- Open till March 31, 2023 and it has not been extended further.

- Only for people aged 60 and above

-Not for NRIs

- Tenure of 10 years

- Minimum Investment 1.5 lakh, Max: 15 lakh

- Return: 8%

· Minimum pension that is earned: The minimum pension for a month, quarter, half-yearly, and yearly are Rs.1,000, Rs.3,000, Rs.6,000, and Rs.12,000, respectively.

· Maximum pension that can be earned: Rs.10,000, Rs.30,000, Rs.60,000, and Rs.1,20,000 is the maximum pension that can be earned for a month, quarter, half-yearly, and yearly, respectively.

The entire family is considered when deciding the maximum pension ceiling. The family under this scheme consists of the pensioner, his/her dependents, and spouse.

· Early Withdrawal

Is premature closing an option? Yes, there is a provision for foreclosing your PMVVY account in the event of a critical or terminal illness – of yourself or your spouse. The surrender value of this senior citizen scheme in such cases is 98% of your initial investment amount or purchase price.

- Tax Treatment - ETT. That means, any amount you earn in this scheme, will be added to your taxable income. Maturity amount will be taxed too.

- PMVVY Calculator: Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Calculator - MyInsuranceClub

Investments in Pradhan Mantri Vaya Vandana are not eligible for deductions to save income tax.

3. Post Office Monthly Income Scheme (POMIS):

- Government backed, so no risk.

- Fixed monthly interest is given.

- Everyone, above the age of 10, can apply.

- Just visit a nearest post office

- Rate of return is 6.1% approximately.

-The scheme is primarily for capital protection.

- Min Investment Rs. 1500. Max Rs. 4.5 lakh in case of a single account and Rs. 9 Lakh in case of joint account.

- Tenure 5 Years. Renewable.

- Tax Treatment ETT, like previous two schemes.

- Early withdrawal penalty of 2%, if withdrawn in first 3 years, and 1% if withdrawn between 3rd to 5th year

- POMIS Calculator: POMIS Calculator - Post Office Monthly Income Scheme Returns Calculator

In case of POMIS, the individual account limit has been raised from Rs.4.5 lakh to Rs.9 lakh, and for a joint account, the amount has been increased from Rs.9 lakh to Rs.15 lakh. At an interest rate of 7.1%, the earlier income of Rs.2,662 a month, or Rs.31,950 a year, for a deposit of Rs.4.5 lakh, would now shoot up to Rs.5,325 a month, or Rs.63,900 a year. For a joint account, this income would be Rs.10,650 a month, or Rs.1,27,800 a year

4. Senior Citizen FD:

- Generally treated like typical FDs, these offer 0.25% to 0.30% extra interest on the principal

- Generally safe, Each depositor in a bank is insured up to a maximum of ₹ 5,00,000 (Rupees Five Lakhs) for both principal and interest amount held by him in the same right and same capacity as on the date of liquidation/cancellation of bank's license or the date on which the scheme of amalgamation/merger/reconstruction comes into force.

- All the earnings are added to taxable income.

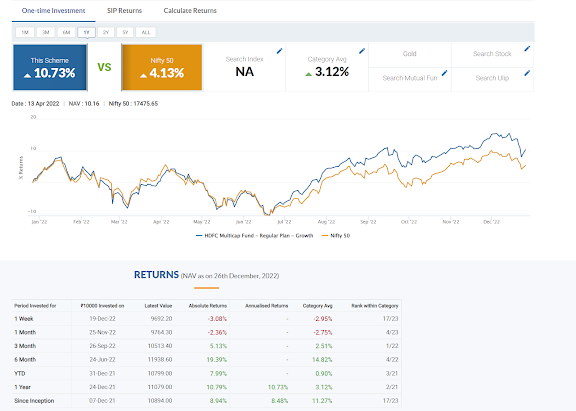

5. Mutual Funds:

- Mutual funds are having too many types.

- Generally debt funds, like ultra short term funds, or short term funds, might work for you.

- For getting the benefit of indexation in tax treatment, one should invest lumpsum in such fund, with high quality paper only, and should prefer taking STP route to withdraw.

- Based on the risk tolerance profile of the senior citizen, some portion can be kept in equity funds as well and STP can be used as a route of withdrawal.

- Equity MFs are more tax efficient, but, they are of course, more risky.

- The hybrid schemes, like Balanced Advantage Schemes, are more recommended to senior citizens. SWP route can be a good way to withdraw fund. Here is a good article, covering the same: How Systematic Withdrawal Plan from Balanced Advantage Fund can be a good idea | Advisorkhoj

- Avoid depending on mutual fund dividends, as their payouts are irregular.

- Please keep in mind that you are taking a big risk by investing in any mutual fund, which has exposure to any equity like asset class. Hence, do not invest more than 10% of your total investible amount in it.

Last option is to buy some dividend yielding stocks. One articleBest Dividend Stocks to Buy in India | Dividend paying Stock (samco.in) covers it well. But do remember, that, overall, your capital won't grow "MUCH" in this method of investing. Plus, there is a substantial risk that you are taking, by investing in stocks directly. Better consult an expert for this.

Comments

Post a Comment